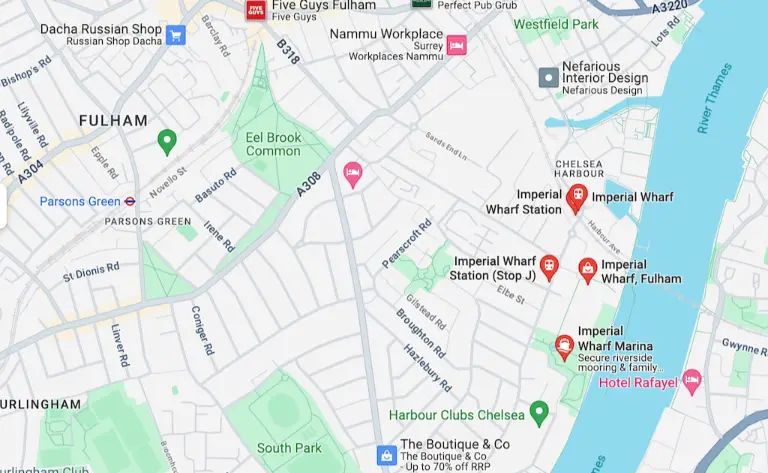

The city of London is currently experiencing a state of home-buying turmoil due to the looming Brexit, resulting in fluctuating house prices and lowered mortgage rates. Interestingly, the housing market has become more affordable recently, with a considerable drop in the cost of homes. Consequently, this has created a competitive market where many buyers, especially from the Middle East and China, are making all-cash offers. Additionally, expert predictions suggesting a post-Brexit surge in house prices have contributed to the current frenzy.

However, if you are unfamiliar with the complexities of purchasing a home, making impulsive decisions to get on the property ladder may lead to future financial regrets. Fear not! Recognizing that the housing market can be intimidating, I have compiled a list of the top five mistakes frequently made by first-time buyers, aiming to help you navigate the process more effectively.

First and foremost, it’s crucial to consider the option of renting a home before automatically opting for a purchase. While buying a home often proves to be a sound financial decision, it may not be suitable in all circumstances. For instance, if you plan to reside in a house for only a few years, the associated completion costs within such a short time frame may make it economically unviable.

Another common mistake made by first-time buyers is failing to consider all the financial implications of purchasing a home. Beyond the house’s cost, there are additional expenses to account for, such as the deposit, stamp duty, maintenance fees, and legal costs. Ignoring these factors can quickly deplete your savings and leave you without emergency funds.

An essential aspect that often gets overlooked is the significance of a thorough home inspection before finalizing a purchase. Conducting an inspection helps identify any faults or issues with the property, allowing you to negotiate with the seller accordingly. This proactive step can potentially save you from incurring significant repair costs after the sale has been completed.

Furthermore, it is a common misconception among first-time buyers that their new home will invariably increase in value. Unfortunately, this is not always the case, and pouring all your savings into a home does not guarantee a higher return on investment. Consulting with a mortgage broker can provide a reality check on house prices and values. Nowadays, relying solely on online platforms like Rightmove or Zoopla may create a distorted perception of true property values in the area.

Lastly, buyers frequently overlook the importance of considering affordability and their debt-to-income ratio before seeking a lender. Failing to assess these factors can lead to disappointment if a lender rejects your mortgage application based on your ability to repay. It is crucial to realize that excessive debt may hinder mortgage approval, and demonstrating a history of saving is essential. Keeping a close eye on your credit score before applying with a lender is vital, as significant changes to your score before closing time could potentially disqualify you.

By keeping these points in mind, you can make informed financial decisions when purchasing a home for the first time. Remember to conduct thorough research, familiarize yourself with the market, and ensure your credit score is as high as possible while maintaining adequate savings before taking the plunge. Most importantly, don’t forget to enjoy the process – it should be an exciting experience!